The Economic Impact of COVID-19 on Small Retail Shops in Nairobi, Kenya

By Jon Helfers, Martha Mutua, and Josiah Muyesu

Introduction

The novel coronavirus (COVID-19) has adversely affected the global community and like most countries, Kenya has not been spared. According to one study, Kenya’s international trade performance, its financial and commodity markets, and the entire macroeconomic environment, have all been affected. This blog takes a microeconomic view, reporting findings from a survey of small retail shops in the country’s capital, Nairobi.

The first case of COVID-19 in Kenya was reported on March 13th, 2020. Soon after, the government took several measures to slow the spread of the virus and to address its health effects, including a dawn to dusk curfew, restrictions on public gatherings, school closings, recommendations to work from home, and social distancing measures. As fears of widespread infection mounted, movement in and out of Nairobi was all but prohibited.

The government also took several measures to limit the economic impact of COVID-19 on Kenyans. It reduced the personal income tax top rate from 30% to 25%, instituted a 100% tax relief for low-income earners, lowered the VAT rate, and reduced the turnover tax rate for SMEs. Nonetheless many Kenyans have been struggling with the economic fallout of COVID-19, despite the policy measures put in place.

In a phone survey of small retailers in and around Nairobi, gui2de-East Africa gathered evidence of the economic effects of COVID-19, and the impacts of subsequent government actions. Respondents reported higher levels of unemployment within their households, an increase in the prices of basic commodities, and the need to take out formal and informal loans to deal with COVID-19. But they reported receiving little or no assistance from the government, NGOs or other entities. Below we elaborate on the background for the survey and its main findings, and suggest some potentially more effective policy interventions.

Sample and Survey

The COVID-19 phone survey was administered to 2,739 small retailers located in the Eastlands district of Nairobi, an area with mostly informal and semi-formal settlements. The retailers were part of an on-going study of small-retailer financing that had commenced about a year before the onset of COVID-19, in which at baseline we had recruited some 3,285 participants. The response rate to the phone survey was 89%.

Collecting data from a sample retailer in 2019 – Photo by Digo Luganda

The shops sold basic foodstuffs including dairy products, household items, and fast-moving consumer goods. Average monthly pre-pandemic turnover in our sample was about 159,000 KSh (USD 1,450), and average monthly profits were about 30,000 KSh (USD 270).

Thephone survey was targeted towards understanding how well the retailers were coping with the effects of COVID-19 both at the business and household levels, and the extent to which government policies had ameliorated those effects. We collected information on such outcomes as household-level employment and job losses, effects of the curfew and cessation of inter-city movement on incomes and economic activity, changes in prices of essential commodities, access to and use of loans, and receipt of government assistance or support from any other source due to the negative effects of the COVID-19. Detailed results of our findings are presented below.

Findings

The economic effects of the pandemic were captured in measures of labor force participation, household incomes, and changes to the prices of essential commodities. While we were not able to collect information in sufficient detail to fully quantify these effects, the responses suggest widespread negative impacts on business activity and household well-being.

Labor market outcomes

COVID-19 has made work impossible for some people, who are unable to perform their normal functions while abiding by social distancing and other prudent public health practices. Through these direct effects on household livelihoods, it has led to ripple effects on other businesses that might nonetheless be able to operate safely, but which face lower demand for their services. Small retailers could be affected in both ways, unable to conduct business without the risk of exposure and infection on the one hand, while potentially facing reduced demand on the other.

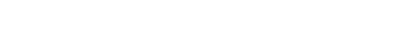

Forty-four percent of the respondents in our survey reported that someone in their household had lost a job due to the pandemic. Of these, two-thirds (nearly 31 percent) reported the loss as temporary, while one-third (nearly 14 percent) said the loss was permanent.

Income effects of public health measures

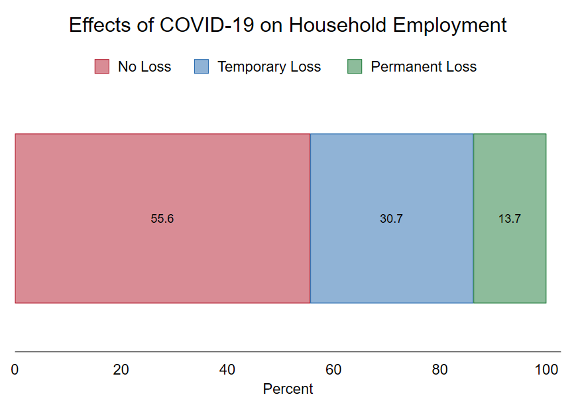

The government’s directive to restrict movement and business operations to certain hours of the day throughout the nation was intended to reduce the spread of the virus. A nighttime curfew in Nairobi permitted businesses to open from 5:00am to 7:00pm, hours that were adjusted periodically by the government based on trends in caseloads and positivity rates. This window would seem at first glance to represent a high proportion of normal operating hours; however, 86% of the retailers reported that the curfew had affected their source of income—which could be because retailers were forced to close their shop early or open later than normal.

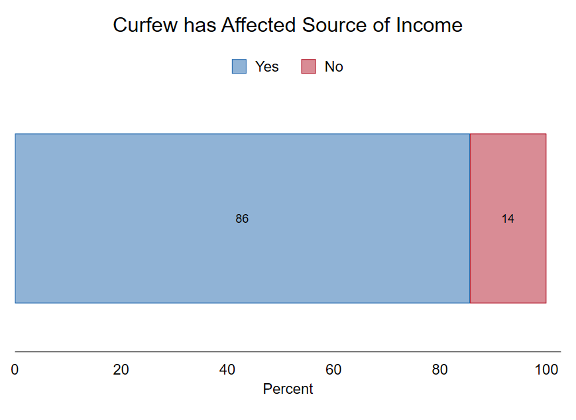

Consistent with the curfew’s effect on respondents’ income, those surveyed reported that the cessation of movement, a government policy that severely restricted the movement of people in and out of Nairobi, also affected income from retail business. Sixty-five percent of respondents reported that cessation of movement had negatively affected their commercial operations.

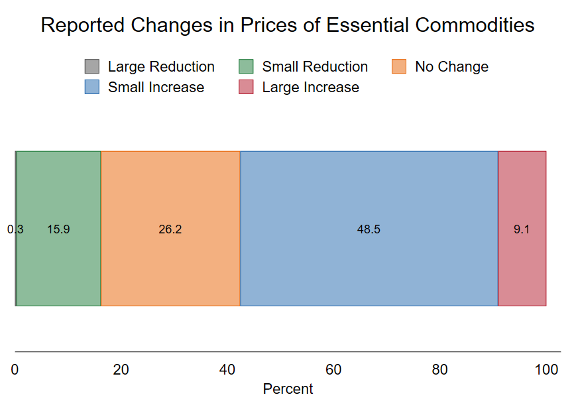

Change in prices of essential commodities

When asked if they had seen any changes in the prices of essential commodities, respondents reported both increases and decreases, which could reflect on the one hand disruptions to supply chains and associated shortages, and plummeting demand as household incomes shrank, on the other. Nearly half of the respondents reported small price increases with an additional 9% reporting large increases to prices of essential commodities. However, almost 16 percent reported a small reduction and just over 26% reported observing no change in the prices of essential commodities. The net impact on households is difficult to assess, as price increases could conceivably boost retailer incomes (but only if sales volumes don’t shrink too much), while reducing household purchasing power.

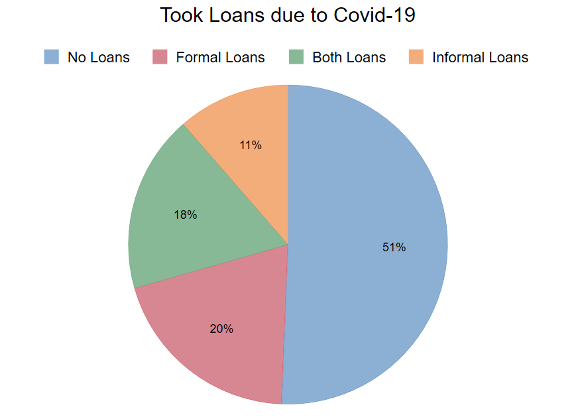

Access to loans

Thirty-eight percent of retailers reported having taken out formal loans from financial institutions due to COVID-19, while 29 percent accessed informal loans from relatives and friends as a way of dealing with the effects of the pandemic. Eighteen percent of respondents took out both informal and formal loans. The graph below shows the distribution of how both formal and informal loans were accessed by the respondents during the period of the phone survey study.

Government Assistance

The government faced the challenge of restricting economic activity in order to control the spread of the coronavirus while at the same time cushioning the impact on households whose income generation opportunities were impacted, either directly by such restrictions, or simply by COVID-19 itself. Income support in general took the form of measures to reduce the tax burden, including:

- complete tax relief for individuals earning gross monthly income of up to KSh 24,000 (USD220), who would otherwise have been subject to a personal income tax at a rate of 10%;

- a reduction in the top personal income tax rate, levied on incomes in excess of KSh 32,333 (USD 300) per month, from 30 to 25%;

- a reduction in the corporate income tax rate from 30 to 25%; and

- a decrease of the value-added tax rate from 16% to 14%.

To supplement the tax relief, a total of 10 billion KSh was allocated by the government (under the Ministry of Labor and Social Services) for an emergency cash transfer program to mitigate the effects of COVID-19 on vulnerable households. Beneficiaries included the elderly, people with disability and orphaned children. The program identified 333,200 households from the 47 counties, each household receiving 1,000 KSh on a weekly basis through a mobile money transfer.

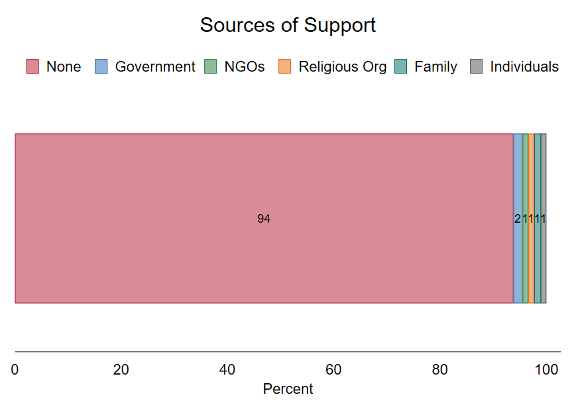

In addition to this support local governments, as well as international and domestic non-governmental organizations responded to the pandemic. We were unable to assess the precise quantitative nature of these various means of assistance, but we did ask our respondents if they had received any support, including from the government (national & local), NGOs, religious organizations, family or friends and private individuals who may have wanted to assist the relief effort. Only 8 percent reported having received such help.

The lack of formal support from government likely derives from the fact that most of our sample is not integrated into the formal sector, and could not automatically access government subsidies or tax relief.

Outlook, Policy Recommendations and Conclusion

Our results show that many of the small businesses in our sample were negatively affected by COVID-19, either directly or as a result of government policies to limit the spread of the virus. Such negative impacts on livelihoods – including job losses, reduced business operations and incomes, and disrupted supply chains – are unintended (if not unforeseen) consequences of the fight to protect lives.

gui2de staff visiting a retailer in 2019 – Photo by Digo Luganda

Some of the survey respondents coped with the negative impacts, at least in the short run, by taking out loans when available from both formal and informal sources. Government assistance was not widely accessed by those in our sample, probably because tax relief is only meaningful for those already paying taxes. In particular, as most of the small shop owners we interviewed operate at or outside the margins of the formal sector, they did not benefit from such policies. In any case, even for tax-paying respondents, the tax relief was small enough that it may simply have gone unnoticed.

In light of these observations, some policy options might include:

- Scale up cash transfer through mobile money:

In order to maintain at least minimal purchasing power, and to ensure that businesses that can operate safely face sufficient demand to allow them to continue to do so, putting cash in the hands (or mobile phones) of households who have suffered job losses or income declines is essential. The challenge of course is one of targeting the transfers to those in such circumstances. A well-functioning and highly inclusive tax system can be an appropriate vehicle, but in its absence, direct transfers must be designed and implemented.

The mobile phone could conceivably serve as a practical delivery mechanism as well as a second-best targeting instrument for such transfers. All the respondents to our survey owned or had access to a mobile phone, virtually all of which were registered with M-PESA or another mobile money service. Historical activity on the platform can be used as a proxy for income or poverty status (see Blumenstock, Cadamuro and On, 2015), and transfers delivered over it. Of course, the targeting efficiency of such a scheme would be highly imperfect, but it could be scaled immediately, and would potentially reach many vulnerable groups, including women and rural residents. Early on in the pandemic, the charity GiveDirectly launched Shikilia , an emergency program of such cash transfers, hoping to reach 200,000 people to whom monthly transfers of $30 were to be made.

- Reconsider the use of income tax relief for formal sector workers.

It is arguable that tax relief for individuals in the formal sector is not well targeted, in the context of offsetting the negative impacts of COVID-19, and that they should be replaced with generous and expanded unemployment benefits. If government support is to be targeted to those who have lost their jobs, unemployment status is the appropriate indicator upon which to base transfers. Of course, all the inefficiencies of unemployment benefit systems will arise, but in the short run, if unemployment status can be confirmed, expanded benefits to those who have lost their jobs will have first-order impacts on the maintenance of spending power at pre-COVID-19 levels.

- Improve the efficiency and inclusivity of credit markets

The pandemic left money households vulnerable and in need of short-term assistance. While many were able to access some kind of credit to help them cope, the riskiness of such loans, from the perspective of lenders, necessarily increased. To protect borrowers from long term consequences of distressed default, the government discontinued the practice of reporting non-payers to the Credit Reference Bureau, which would otherwise have closed off access to future credit. The unintended consequence of this policy was, however, to restrict current access to credit, as lenders tried to reduce their exposure to non-performing loans. The challenge for the regulatory authorities is to ensure that short-term credit can continue to flow to qualifying small businesses and households while maintaining incentives for repayment.